Go-to-Market Slide How To & Examples

Go-to-Market Slide Essentials

Master the fundamental purpose of your GTM slide and its critical distinction from a traditional marketing plan.

Why a GTM Slide Matters

The go-to-market slide serves as your strategic blueprint presentation to investor audiences, demonstrating how your startup will reach customers and generate revenue. Market research data confirms that 90% of successful funding rounds include a comprehensive GTM strategy within their pitch deck. This slide transforms abstract product concepts into concrete business execution plans.

Investor decision-making processes heavily weight GTM viability because it directly correlates with revenue predictability. A well-constructed slide shows your understanding of customer acquisition costs, sales cycles, and channel effectiveness. The slide functions as a bridge between your product vision and financial projections, providing the operational roadmap that investors need to assess investment risk.

GTM vs. Marketing Strategy

Go-to-market strategy encompasses the entire customer journey from initial awareness to post-purchase retention, while marketing strategy focuses specifically on demand generation and brand positioning activities. GTM includes sales processes, channel partnerships, customer success operations, and pricing models within a comprehensive framework.

Marketing strategy operates as a subset within your broader go-to-market approach. Your GTM defines which customer segments to target, how to reach them through multiple touchpoints, and the complete revenue model. Marketing strategy then executes specific campaigns, content creation, and lead generation tactics to support those broader objectives.

Key Elements of a GTM Slide

Discover the core components that transform a GTM slide from a simple list into a compelling, data-driven strategy.

Target Audience and Customers

Your target customer definition must extend beyond basic demographics to include specific pain points, buying behaviors, and decision-making processes. Effective audience identification requires creating detailed buyer personas based on market research, not assumptions. Essential ICP characteristics for B2B products include:

- Company size and annual revenue range

- Budget authority and decision-making hierarchy

- Current technology stack and integration requirements

- Specific pain points that drive purchasing decisions

- Preferred vendor evaluation criteria

Customer segmentation should reflect different acquisition strategies for each segment. Primary segments might require direct sales motion, while secondary audiences could be reached through channel partnerships or self-service models. Document the total addressable market size for each segment, supported by third-party research data whenever possible.

Sales and Marketing Channels

Channel selection depends on your customer’s preferred purchasing journey and your startup’s resource constraints. Direct sales channels work effectively for high-value products requiring consultation, while digital marketing channels suit lower-touch, high-volume products. Multi-channel approaches often prove most effective but require careful resource allocation.

Your channel mix should include both customer acquisition and retention mechanisms. Acquisition channels might include content marketing, paid advertising, partnership programs, or direct outreach. Retention channels encompass customer success programs, upselling processes, and referral systems that reduce overall customer acquisition costs over time.

Financial Metrics

Key financial metrics for your GTM slide should focus on unit economics and scalability indicators. Customer acquisition cost (CAC) represents the total cost of acquiring one paying customer, including marketing spend, sales team costs, and channel partner fees. Lifetime value (LTV) calculations must account for churn rates, expansion revenue, and support costs throughout the customer relationship.

Your GTM slide should present the LTV:CAC ratio, which healthy SaaS businesses maintain above 3:1. Include payback period calculations showing how long it takes to recover acquisition costs. These metrics demonstrate financial sustainability and help investors understand your path to profitability within different growth scenarios.

Competitive Advantage

Your competitive moat within the GTM context focuses on execution advantages rather than just product features. Network effects, proprietary data access, exclusive channel partnerships, or superior customer experience can create sustainable competitive positioning. Document specific advantages that become stronger as your business scales.

Competitive analysis should address both direct competitors and alternative solutions customers currently use. Your competitive advantage might stem from better channel relationships, more efficient acquisition costs, or superior customer retention rates. Quantify these advantages wherever possible using benchmarks from industry reports or publicly available competitor data.

Creating Your GTM Slide

Learn the practical steps to craft a persuasive GTM slide, from structuring key information to designing for maximum impact.

Slide Content

Structure your slide content around the customer journey, starting with target audience identification and ending with retention strategies. Lead with your primary customer segment and the specific problem you solve for them. Follow with your acquisition strategy, including channels, messaging, and expected conversion rates at each stage.

Content hierarchy should prioritize information that directly impacts revenue generation. Include specific tactics rather than generic statements. For example, specify “partnership with Salesforce AppExchange targeting 50,000+ mid-market companies” instead of “strategic partnerships for customer acquisition.” This approach demonstrates operational readiness and market understanding.

Slide Design

Visual design should support information comprehension rather than distract from key messages. Use flowcharts to illustrate customer acquisition processes, tables to present channel effectiveness data, and simple graphics to highlight key metrics. Avoid cluttered layouts that force investors to search for critical information.

Color coding can help differentiate between customer segments, channels, or business models within a single slide. Maintain consistency with your overall deck design while ensuring this slide remains readable during brief presentation timeframes. Include enough detail for standalone comprehension since investors often review slides independently after pitch meetings.

Common Mistakes to Avoid

The most frequent error involves presenting theoretical strategies without supporting evidence. Avoid generic channel lists like “social media, content marketing, partnerships” without specific execution plans or success metrics. Instead, provide concrete examples: “LinkedIn outbound generates 15% response rates with 3-month sales cycles.”

Critical mistakes that weaken GTM slides include:

- Overgeneralized targeting: “Small businesses” instead of “50-200 employee software companies with $10M+ ARR”

- Unsubstantiated projections: Revenue forecasts without clear acquisition math

- Channel overcommitment: Attempting 8+ channels without adequate resources

- Competitor underestimation: Ignoring established players or indirect alternatives

- Metrics misalignment: Focusing on vanity metrics rather than revenue drivers

Another common mistake involves underestimating the complexity of multi-channel coordination. Startups often assume they can execute across numerous channels simultaneously without adequate resources or expertise. Focus on 2-3 primary channels with detailed execution plans rather than spreading efforts across every possible option.

Factors Influencing Your GTM Slide

Tailor your GTM slide to your specific business needs by aligning it with your business model and current funding stage.

How Business Model Affects Your Slide

SaaS business models require different GTM emphasis compared to marketplace or hardware products. SaaS strategies focus on recurring revenue metrics, customer success processes, and expansion opportunities within existing accounts. Marketplace models emphasize network effects, two-sided customer acquisition, and platform growth dynamics.

Freemium models need detailed conversion funnels showing how free users transition to paid subscriptions. Enterprise software requires longer sales cycles with multiple stakeholder involvement, while consumer products might emphasize viral growth mechanisms and user-generated content strategies. Your slide should reflect these model-specific requirements clearly.

How Funding Stage Affects Your Slide

Seed-stage presentations should emphasize early validation signals and initial customer feedback rather than scaled execution plans. Investors at this stage want to see market understanding and founder-market fit more than operational sophistication. Include pilot program results, early customer interviews, and initial traction data.

Series A and later stages demand more sophisticated metrics and proven execution capabilities. Your slide should demonstrate repeatable customer acquisition processes, predictable conversion rates, and clear path to market leadership. Include cohort analysis, channel optimization data, and competitive win rates to show operational maturity and scalability potential.

GTM Slide Examples

AirBNB

A platform that disrupted the hospitality industry by connecting travelers with hosts offering unique accommodations and local experiences.

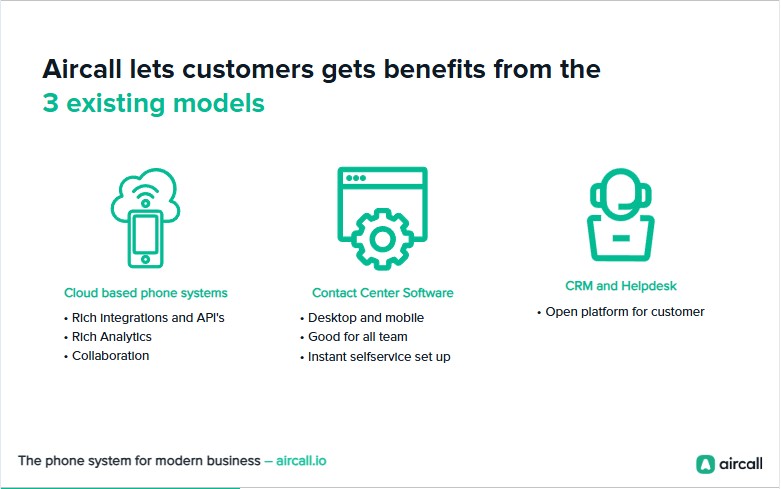

AirCall

A cloud-based phone system designed for sales and support teams, allowing businesses to easily manage calls and integrate with other tools.

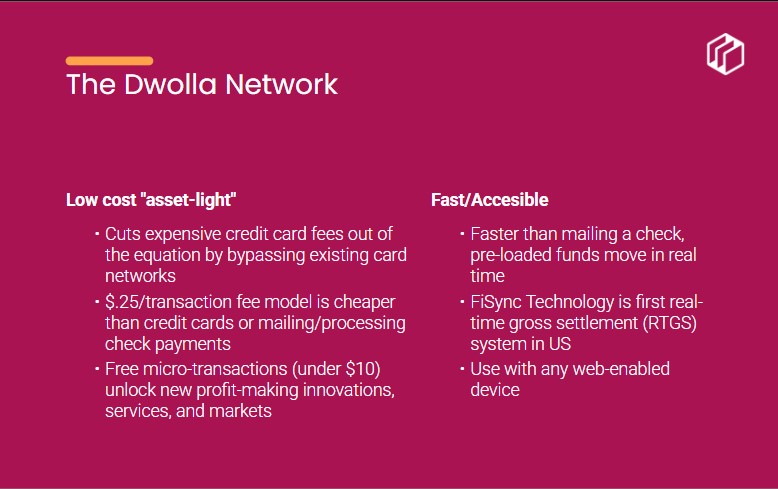

Dwolla

A digital payments platform that enables businesses to securely and efficiently send and receive bank transfers at scale, serving as a modern payment network.

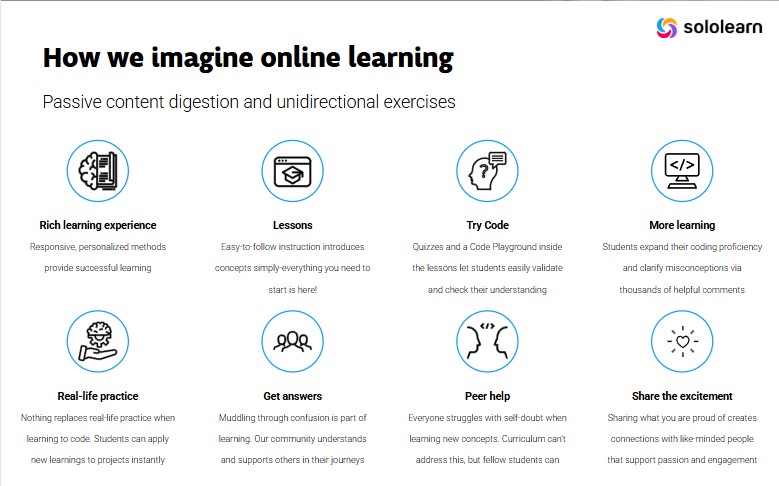

SoloLearn

A mobile-first platform that makes coding accessible to everyone through short, interactive lessons, quizzes, and a supportive community for free.

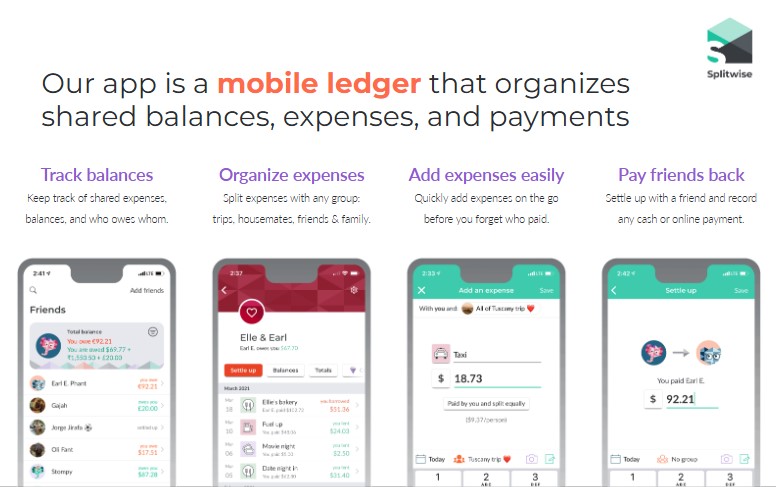

SplitWise

An app that simplifies the complex task of splitting bills and IOUs among friends and groups, making it easy to track who owes what.