Series A Funding and Financing for a Startup

Series A funding marks the transition from early-stage experimentation to institutional investment, representing the first formal venture capital round where startups exchange equity for substantial growth capital. This financing mechanism establishes professional investor relationships and introduces sophisticated governance structures that shape company development trajectories. Startups usually embark on this round to scale operations and move to the next level of growth.

What is a Series A round?

Series A funding represents the first round of financing where startups exchange equity for substantial capital from institutional investors. This round of financing typically ranges from $2 million to $15 million, though amounts can vary significantly based on industry and growth potential. Unlike informal funding mechanisms, Series A rounds establish formal valuation methodologies and introduce preferred stock structures that protect investor interests. This is also known as Series A financing.

The defining characteristic of a Series A round lies in its priced round nature. Venture capital firms conduct comprehensive due diligence processes lasting 8-12 weeks, evaluating business models, market traction, and scalability metrics. This rigorous assessment determines the company’s pre-money valuation, which forms the foundation for equity distribution calculations.

These lead investors typically secure board seats and protective provisions that influence major corporate decisions, including future funding rounds and strategic direction changes.

Series A vs. Seed financing

Seed capital and Series A financing serve distinctly different purposes in startup development trajectories. Initial seed funding typically ranges from $50,000 to $2 million and focuses on product development, market validation, and team formation. Venture capitalists and angel investors provide this early-stage capital in exchange for convertible notes or equity stakes.

Series A investors require demonstrated traction metrics that seed-stage companies rarely possess. Revenue growth, customer acquisition costs, and retention rates become critical evaluation criteria. While seed financing supports proof-of-concept development, Series A capital enables market expansion and operational scaling. The returns from seed funding are typically lower than the returns from Series A due to the higher risk.

The structural differences extend beyond the amount of funding. Seed financing often utilizes convertible preferred shares that convert during subsequent rounds, while Series A rounds establish fixed valuations and preferred stock classes. Due diligence processes for seed funding typically require 2-4 weeks, compared to the extensive 2-3 month evaluation periods for Series A rounds.

| Funding Stage | Typical Amount | Primary Purpose | Investor Type | Due Diligence Period |

| Seed | $50K – $2M | Product development, market validation | Angel investors, seed VCs | 2-4 weeks |

| Series A | $2M – $15M | Market expansion, team scaling | Institutional VCs | 8-12 weeks |

The goal of Series A capital

Series A funding serves as the catalyst for transforming validated business concepts into scalable enterprises. The primary objective involves accelerating revenue growth through expanded sales and marketing operations, enhanced product development capabilities, and strategic team additions across key functional areas. The goal is to grow and scale the business.

Within the framework of financial modeling, Series A capital allocation typically follows established patterns. Companies dedicate 40-50% of funding to sales and marketing initiatives, 25-35% to product development and engineering resources, and 15-25% to operational infrastructure improvements. This distribution reflects the growth-oriented nature of Series A financing goals. The product or service is a central focus during this stage.

Venture capitalists evaluate Series A opportunities based on return potential metrics, typically expecting 10x-20x returns over 5-7 year investment horizons. This expectation drives investor focus toward companies demonstrating clear paths to $100+ million annual recurring revenue within reasonable timeframes.

Series A Investment

The investment dynamics of Series A funding rounds involve sophisticated financial instruments and experienced institutional investors who bring both capital and strategic expertise to growing companies. These rounds establish the foundation for professional governance and operational scaling. This type of financing is a major step for startups.

Key characteristics of Series A investors

Series A investors predominantly consist of institutional venture capital firms managing funds ranging from $50 million to $1 billion. These firms employ specialized investment professionals with sector expertise in technology, healthcare, consumer products, and B2B services. Partner-level investors typically possess a track record of 10-20 years of experience building and scaling companies within specific industry verticals.

Investment criteria for Series A rounds emphasize quantifiable traction metrics over theoretical potential. The essential requirements that Series A investors evaluate include:

- Monthly recurring revenue growth rates exceeding 15-20%

- Customer acquisition costs below 3x lifetime value ratios

- Gross margins above 70% for software companies

- Demonstrated product-market fit through customer retention metrics

Geographic concentration significantly influences Series A investor characteristics. Silicon Valley-based VC firms manage approximately 45% of total venture capital assets, followed by Boston, New York, and emerging hubs like Austin and Denver. This concentration creates competitive advantages for startups located within established venture capital ecosystems, though remote investment trends have increased geographic flexibility.

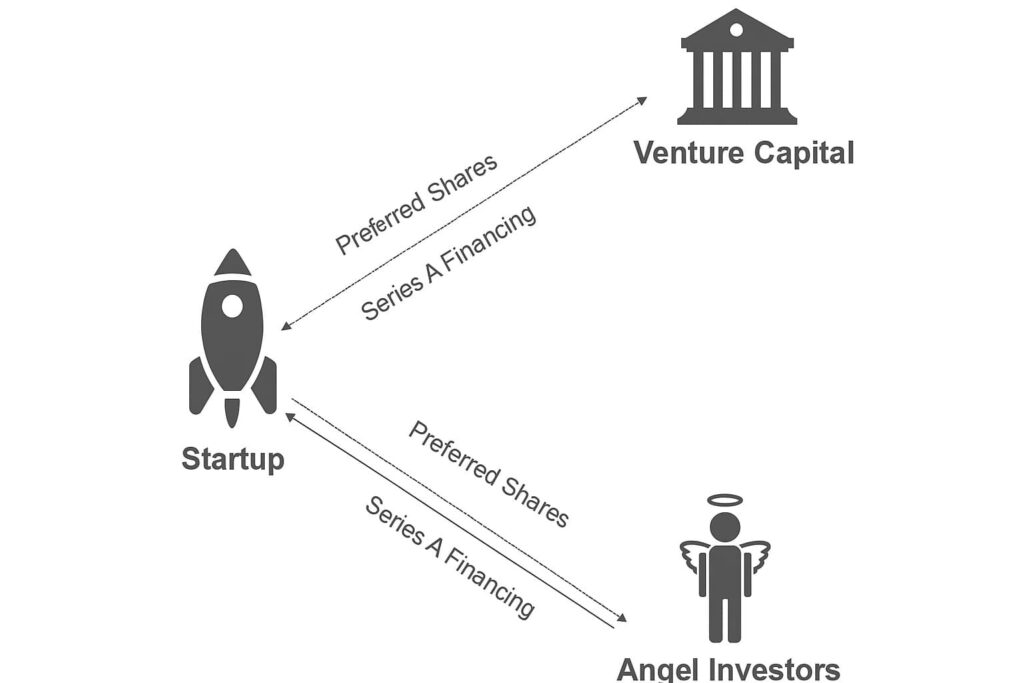

What an investor receives for an investment

Series A investors receive preferred shares that provide liquidation preferences, anti-dilution protections, and voting rights on major corporate decisions. These preferred shares rank ahead of common stock during liquidity events, ensuring investors recover their initial investment before founders and employees receive distributions. In exchange for their investment, investors will receive these shares.

Liquidation preferences typically range from 1x to 2x, meaning investors receive their original investment amount multiplied by the preference multiple before common stockholders participate in proceeds. Anti-dilution provisions protect investors from valuation decreases in future funding rounds through weighted average or full ratchet mechanisms.

Board representation constitutes another critical component of Series A investments. Lead investors typically secure one board seat, with additional seats allocated to independent directors and founder representatives. This governance structure enables investors to influence strategic decisions while maintaining alignment with management objectives.

Investment agreements also include information rights requiring regular financial reporting, operating metrics disclosure, and advance notification of material events. These provisions enable investors to monitor portfolio company performance and provide strategic guidance during growth phases. This is all part of the return on their investment.

Convertible securities

Convertible preferred shares represent the standard structure for Series A financing rounds. These securities combine debt-like protective features with equity upside potential, creating alignment between investor and founder interests while providing downside protection for capital providers. The investors have the option to convert their investment.

The conversion mechanism triggers automatically during qualified financing rounds exceeding predetermined thresholds, typically $5-10 million for Series B rounds. Investors also retain conversion rights at their discretion, enabling strategic timing decisions based on market conditions and company performance. This gives them the option to convert their preferred shares.

Participating preferred structures allow investors to receive liquidation preferences plus pro-rata participation in remaining proceeds after all preferences are satisfied. This “double-dip” mechanism increases investor returns during moderate exit scenarios while maintaining upside participation during high-value liquidity events.

Convertible note bridges occasionally precede formal Series A rounds when companies require immediate capital while negotiating term sheets. These instruments convert into Series A preferred shares at predetermined discounts, typically 15-25% below the Series A price per share. The company may also issue convertible preferred shares to investors in exchange for funding.

The Process to Raise Funds

Fundraising for Series A rounds requires systematic preparation, strategic timing, and skilled negotiation to achieve optimal outcomes for both founders and investors. The process demands significant time investment and operational focus during critical company growth phases. This is all part of raising capital.

When a startup is ready to raise

Startups become ready to raise Series A funding when key performance indicators demonstrate sustainable growth trajectories and market validation. Revenue metrics serve as primary readiness indicators, with monthly recurring revenue growth rates above 20% and annual run rates approaching $1-3 million signaling investor interest potential. This is a critical stage of development.

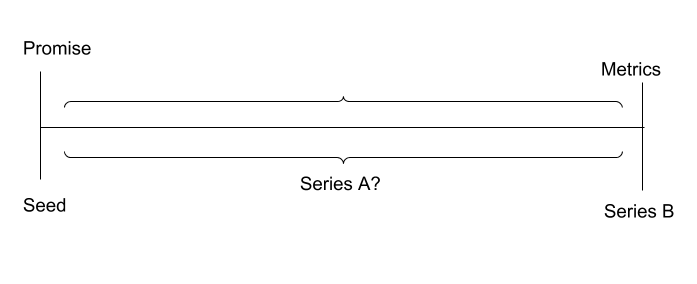

YCombinator has created a graph that shows where the Series A round should exist between seed and Series B.

Product-market fit evidence becomes essential before initiating Series A processes. This validation manifests through customer retention rates exceeding 90% annually, net promoter scores above 50, and organic growth accounting for 30%+ of new customer acquisition. Without these traction metrics, investors typically recommend extending seed stage operations.

Team composition and milestone achievement also influence Series A readiness timing. Companies require proven leadership teams with relevant industry experience, established customer success processes, and documented competitive advantages. Technical milestones, such as platform scalability demonstrations and intellectual property development, strengthen investor confidence during due diligence evaluations.

Market timing considerations affect Series A success probability. Economic conditions, sector-specific investment trends, and competitive landscape developments influence investor appetite and valuation expectations. Companies monitoring these external factors can optimize fundraising timing for maximum success probability.

The fundraising process from start to finish

The Series A fundraising process typically spans 4-6 months from initial preparation through final closing. Preparation phases require 6-8 weeks for pitch deck development, financial model creation, and data room organization. Companies must compile three years of historical financial data, customer references, legal documentation, and competitive analysis materials. This is an integral part of securing Series A funding.

Investor outreach follows systematic approaches targeting 20-30 qualified venture capital firms with relevant sector focus and stage preferences. Initial meetings occur through warm introductions from existing investors, advisors, or portfolio company connections. Cold outreach success rates remain below 5%, making network leverage essential for efficient fundraising processes. You will have to pitch your startup to gain interest.

The complete Series A fundraising timeline encompasses these critical phases:

- Preparation and documentation: 6-8 weeks

- Initial investor meetings and pitches: 4-6 weeks

- Due diligence and deeper evaluation: 8-12 weeks

- Term sheet negotiation and legal documentation: 4-6 weeks

Due diligence processes intensify after initial investor interest confirmation. Venture capital firms conduct management interviews, customer reference calls, financial audits, and market analysis over extended evaluation periods. Multiple firms may pursue parallel due diligence tracks, creating time pressure for founders while enabling competitive dynamics.

Negotiating terms with investors

Valuation negotiations form the cornerstone of Series A term discussions, balancing founder dilution concerns with investor return requirements. Pre-money valuations typically range from $8-25 million for first-time Series A rounds, though exceptional companies command premium valuations based on growth metrics and competitive dynamics.

Board composition negotiations determine corporate governance structures for subsequent operational periods. Founders often retain board control through Series A rounds, though investor board seats increase influence over strategic decisions. Independent director selections require mutual agreement between founders and investors, creating balanced governance frameworks.

Liquidation preference negotiations affect founder returns during exit scenarios. Standard 1x non-participating preferences provide investor downside protection without limiting founder upside potential. Participating preferences or preference multiples above 1x shift economics toward investors, requiring careful evaluation of long-term implications. The negotiation process comes with its own set of challenges.

Anti-dilution provisions protect investors from valuation decreases in future funding rounds. Weighted average anti-dilution mechanisms provide moderate protection while maintaining founder incentive alignment. Full ratchet provisions offer maximum investor protection but create potential misalignment during challenging market conditions.

Beyond the Series A Round

The completion of Series A funding marks the beginning of accelerated growth phases that require sustained execution across multiple operational dimensions while preparing for subsequent financing rounds and eventual liquidity events.

The Series A to IPO journey

The progression from Series A funding to initial public offerings typically requires 5-8 years and multiple additional funding rounds. Companies must achieve $100+ million annual recurring revenue with 20%+ growth rates to attract IPO investment banking interest. This trajectory demands consistent execution across product development, market expansion, and operational scaling initiatives.

Series B and C funding rounds enable continued growth acceleration, with round sizes typically doubling at each stage. Series B rounds average $15-40 million, while Series C funding often exceeds $50 million. Each subsequent round introduces new investor classes, including growth equity firms and strategic corporate investors seeking pre-IPO exposure.

IPO readiness requirements extend beyond financial metrics to include governance structures, regulatory compliance, and public market communication capabilities. Companies must demonstrate predictable revenue streams, established competitive moats, and total addressable markets exceeding $10 billion to support public market valuations.

Market conditions significantly influence IPO timing decisions. Technology IPO activity correlates with public market valuations, venture capital deployment rates, and investor risk appetite cycles. Companies maintaining flexible growth strategies can optimize public market entry timing for maximum valuation capture.

Comparing Series A to Series B and C funding stages

Series B funding rounds focus on market expansion and competitive positioning rather than product-market fit validation. Round sizes typically range from $15-40 million, supporting geographic expansion, customer segment diversification, and acquisition opportunities. Series B investors evaluate market leadership potential and sustainable competitive advantages.

Due diligence processes become more sophisticated at Series B stages, incorporating competitive intelligence, market sizing analysis, and operational efficiency assessments. Investors examine unit economics sustainability, customer concentration risks, and management team scalability during expanded evaluation periods.

Series C rounds often serve as pre-IPO growth acceleration vehicles, with round sizes frequently exceeding $50 million. These rounds attract growth equity firms, sovereign wealth funds, and strategic corporate investors seeking late-stage exposure. Valuation methodologies shift toward public market comparables and discounted cash flow models.

The key distinctions between funding stages reflect evolving company maturity and investor expectations:

- Series A emphasizes product-market fit validation and initial scaling capabilities.

- Series B focuses on market expansion, competitive differentiation, and operational excellence.

- Series C prioritizes market leadership, profitability pathways, and IPO preparation.

Each stage demands progressively sophisticated metrics, governance structures, and strategic planning.

| Funding Stage | Average Round Size | Primary Focus | Key Metrics | Typical Investors |

| Series A | $2M – $15M | Product-market fit, initial scaling | Revenue growth, customer retention | Institutional VCs |

| Series B | $15M – $40M | Market expansion, competitive positioning | Market share, unit economics | Growth VCs, later-stage funds |

| Series C | $50M+ | Pre-IPO growth, market leadership | Revenue scale, profitability path | Growth equity, strategic investors |

Series A as a critical funding stage

Series A funding represents the most critical inflection point in startup development trajectories, determining long-term success probability more than any other single factor. Success rates for companies completing Series A rounds exceed 40%, compared to sub-10%

success rates for seed-stage companies that fail to progress to institutional funding.

The disciplined capital allocation required during Series A stages establishes operational frameworks that persist throughout company growth phases. Companies developing systematic approaches to customer acquisition, product development, and team scaling during Series A periods maintain competitive advantages through subsequent funding rounds and market expansion phases.

Investor network effects amplify Series A importance beyond immediate capital provision. Leading venture capital firms provide strategic guidance, customer introductions, partnership opportunities, and follow-on funding access that compound over time. These network benefits often determine competitive outcomes in crowded market segments.

Series A timing decisions significantly impact long-term company trajectories. Companies raising Series A rounds during favorable market conditions achieve higher valuations and more favorable terms, creating lasting advantages through reduced dilution and enhanced investor support networks. Conversely, companies forced to raise during challenging market periods may face structural disadvantages that persist through multiple funding cycles.