The Essential Guide to Venture Capital Lists: Finding Your Ideal Investor in 2025

Founders today navigate an increasingly complex fundraising landscape where identifying the right investors has become a critical success factor. Market research data confirms that while over 3,000 active venture capital firms operate globally, only a fraction align with any specific startup’s stage, sector, and geographic focus. The proliferation of investor lists across the internet creates an additional challenge—many lists contain outdated information, inactive funds, or lack the granular details necessary for effective outreach. This comprehensive resource addresses the fundamental problem of investor discovery by providing vetted, current lists that demonstrate proven track records in connecting founders with relevant capital sources. Within the framework of strategic fundraising, accessing quality investor data reduces the time-to-funding cycle and increases conversion rates from initial outreach to meaningful conversations. The following guide consolidates the most effective venture capital lists available in 2025, organized by geography, focus area, and access model. Each resource has been evaluated based on data accuracy, update frequency, and practical utility for founders seeking to optimize their fundraising efforts.

Regional VC Databases: Targeting Your Local Market

Geographic proximity remains a significant factor in venture capital investment decisions, with regional investors often providing superior market knowledge, regulatory expertise, and network access. Depending on market conditions, local investors may also offer faster decision-making processes and more flexible deal structures compared to distant capital sources.

United States

The US venture capital market represents the largest and most diverse ecosystem globally, requiring specialized lists to navigate effectively across different regions, sectors, and investment stages.

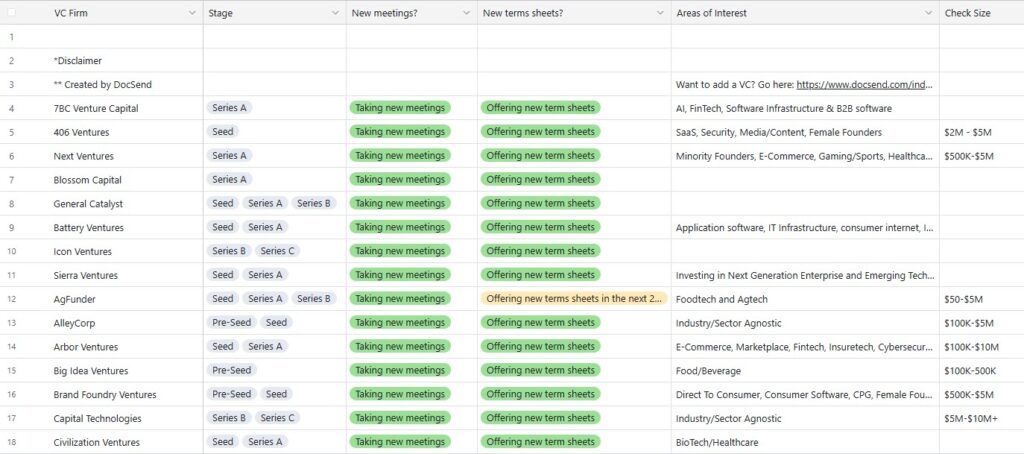

DocSend

DocSend leverages its position as a leading pitch deck platform to maintain current information on active US venture capital firms by tracking engagement metrics from actual fundraising processes, which provides insights into financier responsiveness and active interest areas. Founders using DocSend gain access to curated lists of VCs who have demonstrated recent activity, with:

- Firm-specific data on typical response times.

- Preferred presentation formats.

- Sector preferences derived from usage patterns.

Mercury

Mercury’s investor list emerges from its role as a preferred banking solution for US startups, fostering natural connections within the venture capital ecosystem through relationships with hundreds of venture firms via their portfolio companies’ banking activities. This unique position results in verified contact information and current investment activity data, focusing primarily on US-based funds with active startup portfolios and ensuring regular updates as new funds emerge or strategies change.

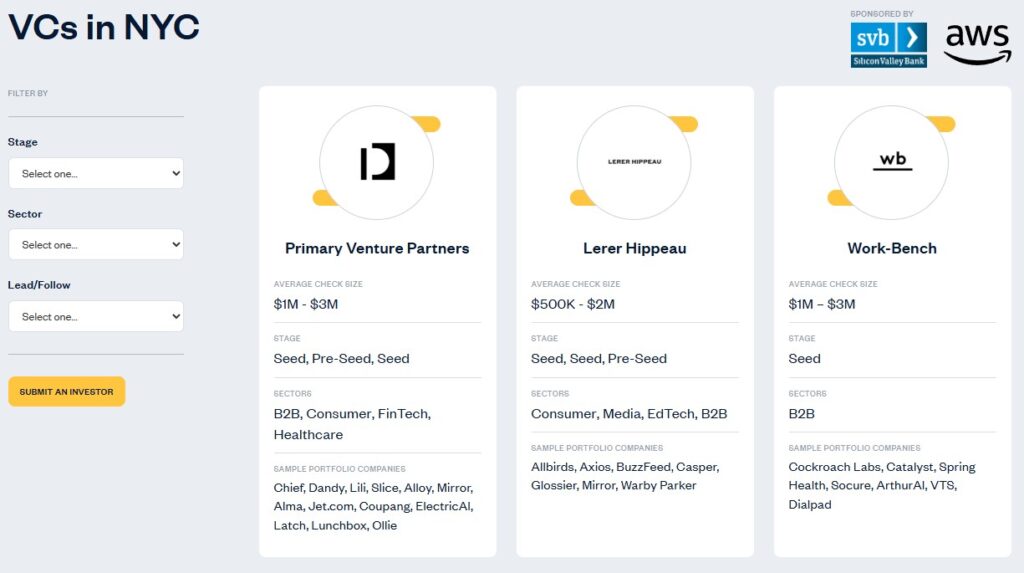

NYC Founder Guide

The NYC Founder Guide is a specialized directory addressing the unique characteristics of New York City’s venture capital landscape, which spans fintech, media, enterprise software, and consumer sectors. The guide maintains detailed profiles of VCs and angel investors with an active New York presence, including:

- Information on preferred meeting locations.

- Industry events.

- Local network connections.

It proves invaluable for founders seeking investors who understand New York’s specific market dynamics, regulations, and talent ecosystem.

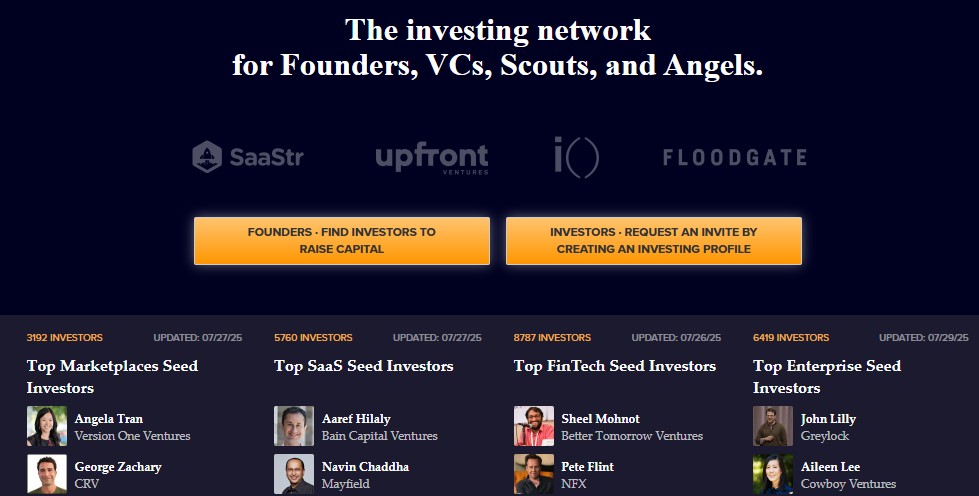

Signals by NfX

Signals by NfX functions as a network leverage tool rather than a traditional database, allowing founders to identify warm introduction paths to target investors by analyzing their professional networks across platforms like LinkedIn and email contacts. Market research confirms that warm introductions generate significantly higher response rates, making Signals particularly valuable for founders with established networks, as its algorithm continuously updates to reflect changing relationships and new connection opportunities.

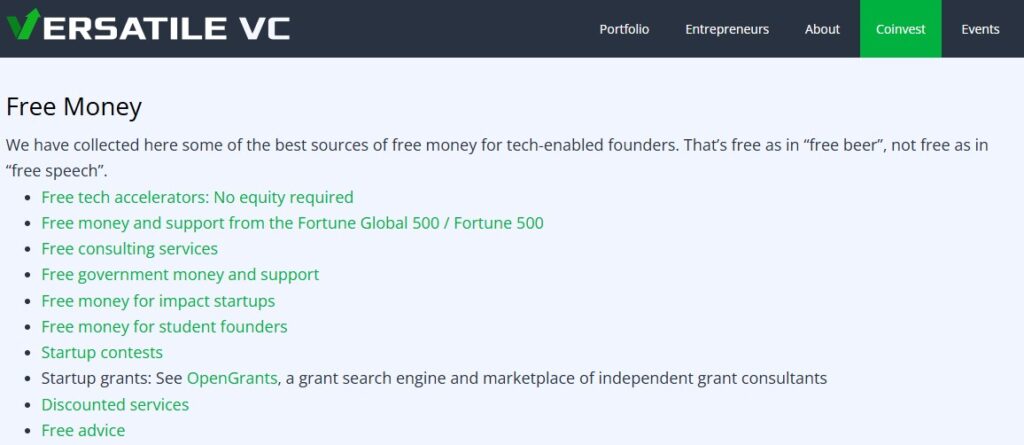

Versatile VC

Versatile VC curates non-traditional funding opportunities for US founders, expanding beyond conventional venture capital to include grants, competitions, accelerator programs, corporate venture arms, family offices, and government funding that might otherwise be overlooked. This resource is especially valuable for early-stage companies that may not yet meet traditional VC criteria but can access alternative capital sources, with the platform regularly updating to reflect new programs and changing qualification requirements.

Folk (US VCs)

Folk provides a structured compilation of US funds, accelerators, and angel investors, organized by investment stage, sector focus, and geographic preference, actively filtering out dormant funds and inactive individual investors to emphasize active investors with recent deal activity. The platform’s organization facilitates efficient market research, enabling founders to quickly identify relevant financier segments and build targeted outreach lists through regular curation that keeps contact information current and investment theses accurate.

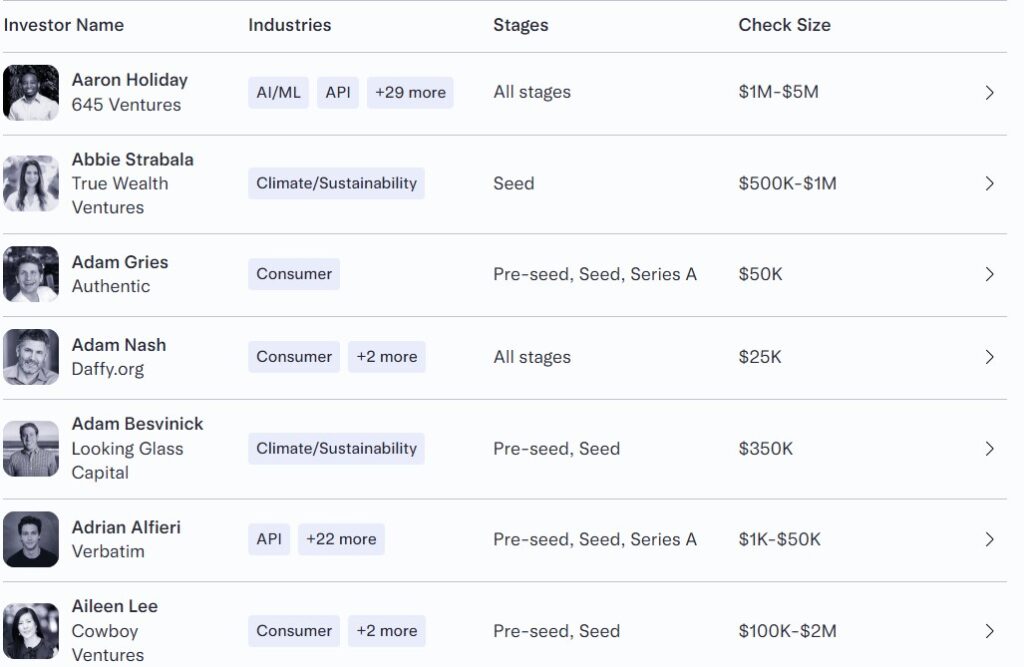

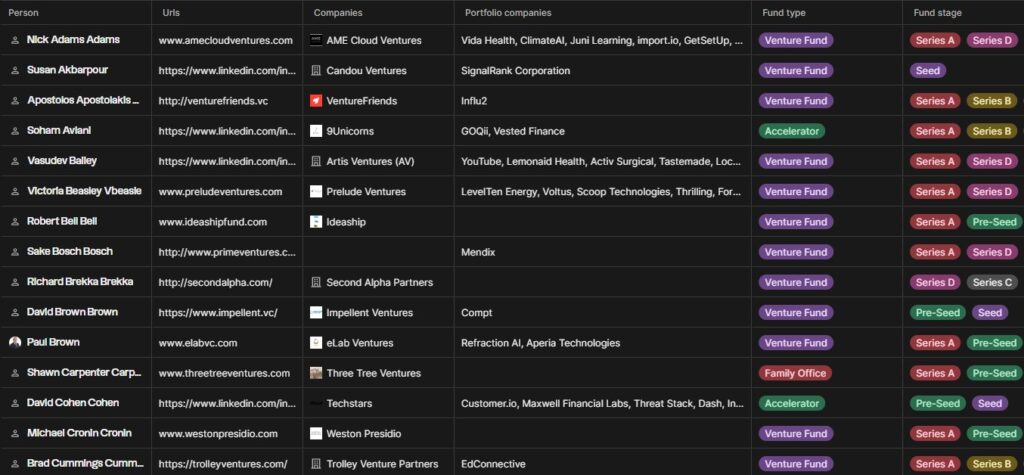

AngelList

AngelList is the world’s largest startup and VC networking platform, serving as a comprehensive ecosystem where founders can discover and connect with both venture capital and angel investors. It provides tools for fundraising, recruiting, and company building, acting as a direct conduit for founders to showcase their startups to a vast network of potential investors, streamlining the process of finding and engaging with capital sources.

Europe

European venture capital markets exhibit significant diversity across countries, regulatory frameworks, and sector specializations, requiring region-specific resources for effective financier identification and outreach.

EuroVC

EuroVC provides comprehensive coverage of venture capital firms operating across European markets, including detailed information on:

- Investment strategies.

- Portfolio companies.

- Fund characteristics.

It spans traditional European venture hubs like London, Berlin, and Paris, as well as emerging markets in Eastern Europe, maintaining current data on fund sizes, investment stages, and sector preferences.

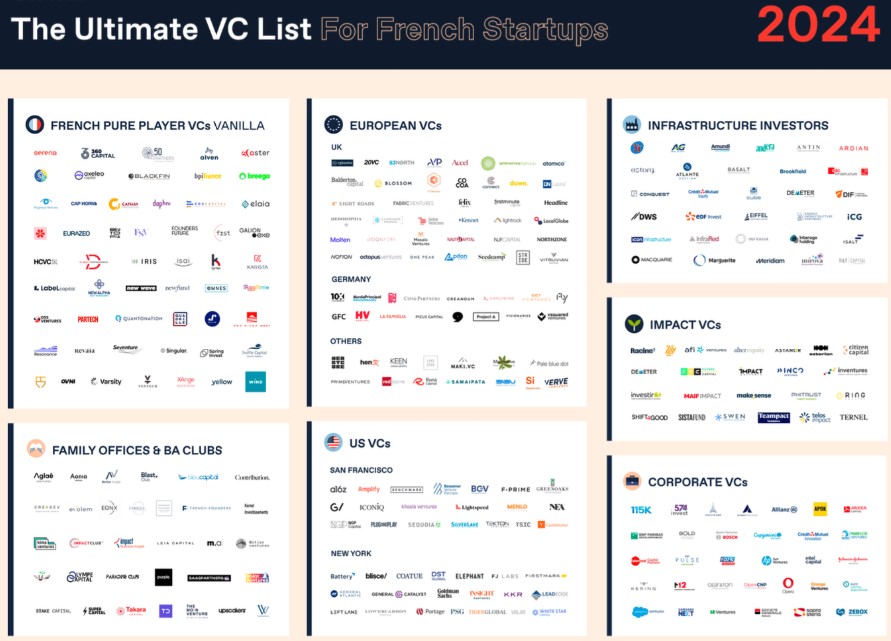

Ultimate VC List

Maintained by Serena Capital, a prominent French VC firm, the Ultimate VC List is a curated list of active French venture capital firms that leverages the firm’s deep market knowledge to provide accurate and current information. This resource includes:

- Detailed firm profiles with investment thesis descriptions.

- Typical deal structures.

- Portfolio company examples specific to the French market.

It proves invaluable for founders seeking to understand local market dynamics and regulatory considerations.

Find My VC

Developed by Xange, another French fund, Find My VC is a tool that generates customized shortlists of relevant French venture capital firms based on specific startup characteristics such as sector, stage, business model, and funding requirements. The platform’s algorithm analyzes historical investment patterns to predict financier interest levels and provide personalized recommendations, offering a more efficient approach than manual list searches by leveraging actual investment data.

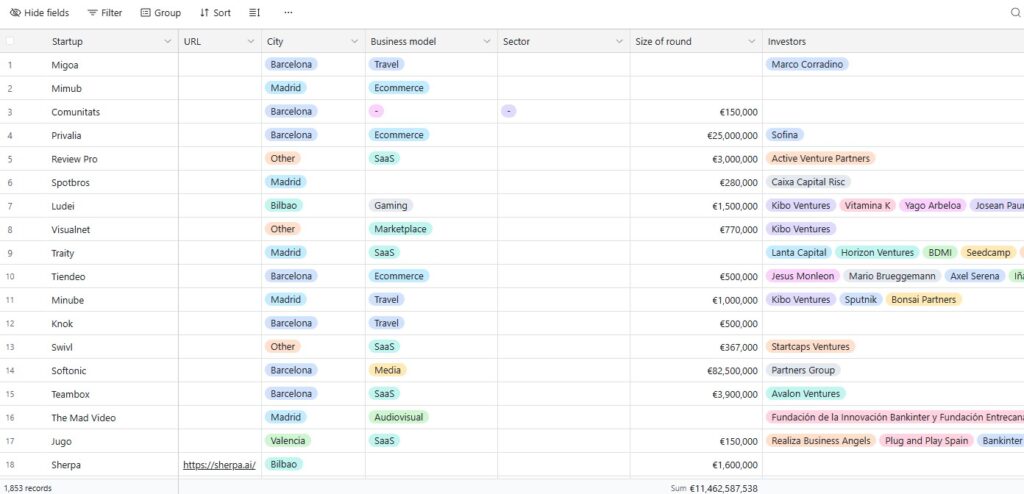

KFund

While primarily a deal database, KFund’s comprehensive tracking of Spanish venture capital transactions allows for reverse analysis to identify active investors in the Spanish market, documenting deal structures, investment amounts, and participating investors across Spanish venture transactions. Founders can analyze these investment patterns to identify firms with active deployment strategies, preferred deal sizes, and sector specializations within the Spanish ecosystem, providing data-driven insights beyond traditional firm profiles.

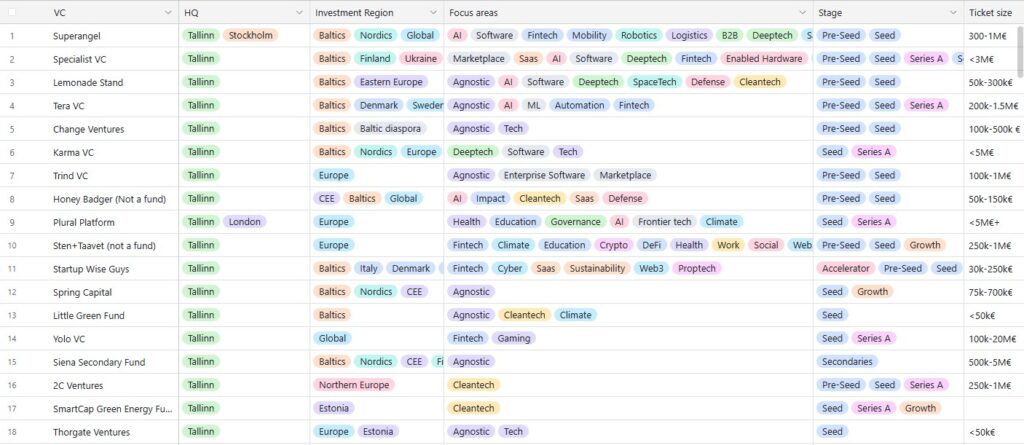

Superangel.io

This specialized database, Superangel.io, focuses specifically on venture capital firms active in Baltic markets, providing detailed information on investors with demonstrated track records in Estonia, Latvia, and Lithuania. The platform maintains current information on fund characteristics, investment strategies, and portfolio company examples tailored to Baltic ecosystems, proving essential for founders in these markets where local knowledge significantly influences investment success.

Asia & Oceania

Rapidly growing venture capital markets across Asia and Oceania require specialized lists that reflect local investment practices, regulatory frameworks, and ecosystem dynamics.

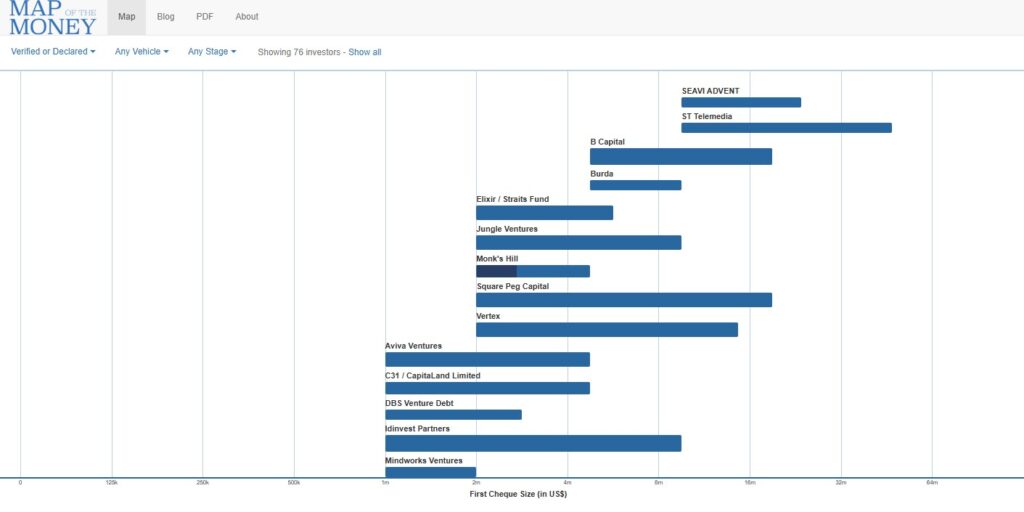

Map of the Money (Singapore)

This interactive platform, Map of the Money, provides comprehensive coverage of venture capital firms active in Singapore’s strategic position as a Southeast Asian hub. The list includes detailed firm profiles with investment strategies, portfolio companies, and fund characteristics specific to Southeast Asian markets. Singapore’s role as a regional venture capital center means many firms listed maintain investment interests across broader Southeast Asian markets, making this resource valuable for founders throughout the region. The platform’s interactive format enables efficient exploration of financier networks and portfolio connections.

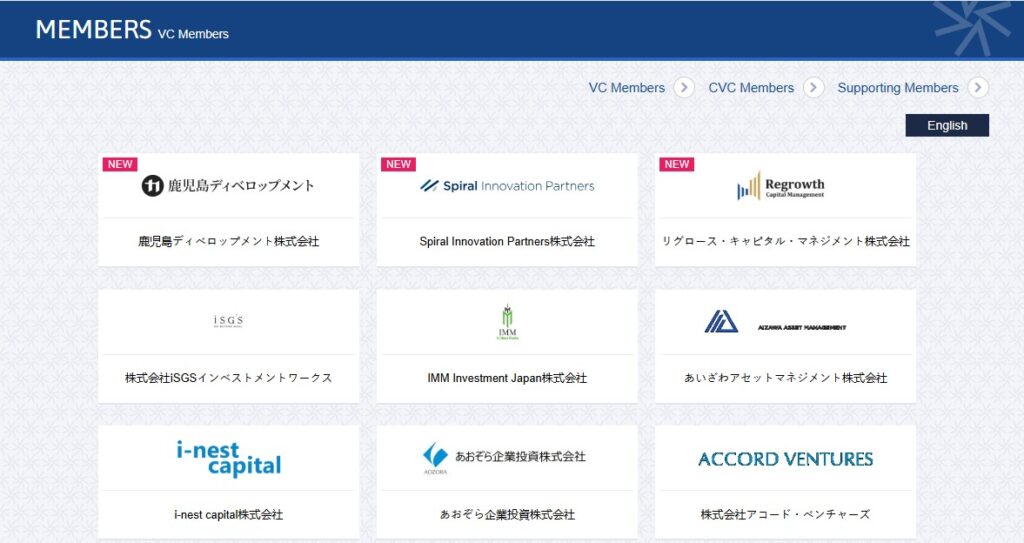

JVCA

The Japanese Venture Capital Association (JVCA) maintains this authoritative directory of venture capital firms active in Japanese markets. The list provides essential information for navigating Japan’s unique venture ecosystem, including:

- Investment practices.

- Regulatory considerations.

- Market entry strategies.

Japan’s venture market exhibits distinct characteristics compared to Western markets, making specialized local knowledge essential for successful fundraising. The JVCA list provides the foundation for understanding Japanese financier preferences and market dynamics.

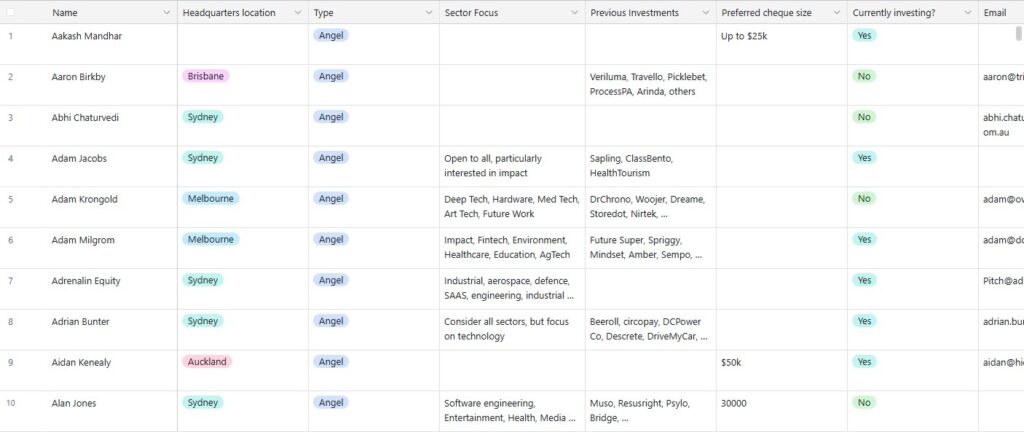

Airtree (Australia)

Airtree’s comprehensive list covers both institutional venture capital firms and angel financier networks active in Australian markets. The platform maintains separate directories for different financier types, enabling founders to target appropriate capital sources based on their stage and funding requirements. Australia’s venture ecosystem combines institutional funds with active angel networks, requiring founders to navigate both channels effectively. Airtree’s dual approach provides comprehensive coverage of available capital sources across the Australian market.

Africa & Middle East

Emerging venture capital markets across Africa and the Middle East require specialized resources that reflect local investment practices, infrastructure considerations, and regulatory frameworks.

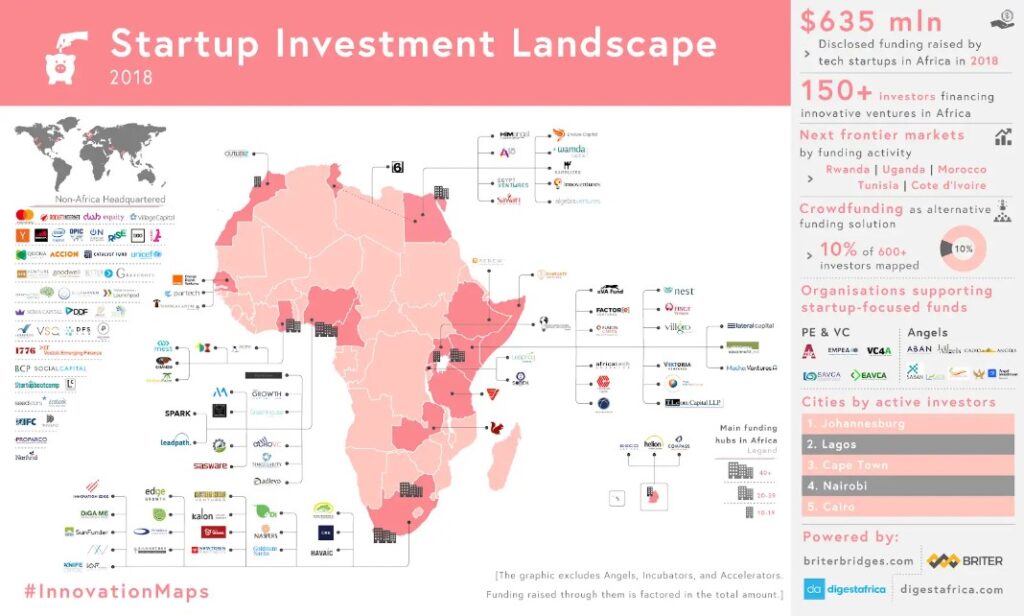

Briter Bridges

This comprehensive mapping platform, Briter Bridges, covers venture capital firms across African markets, providing essential information for founders seeking to access continental capital sources. Despite its 2018 publication date, the platform remains highly relevant as many listed firms continue active investment activities across African markets. The list addresses the fragmented nature of African venture markets by providing comprehensive geographic coverage and detailed firm profiles. Regular reference to this resource helps founders understand the continental venture landscape and identify potential regional expansion opportunities.

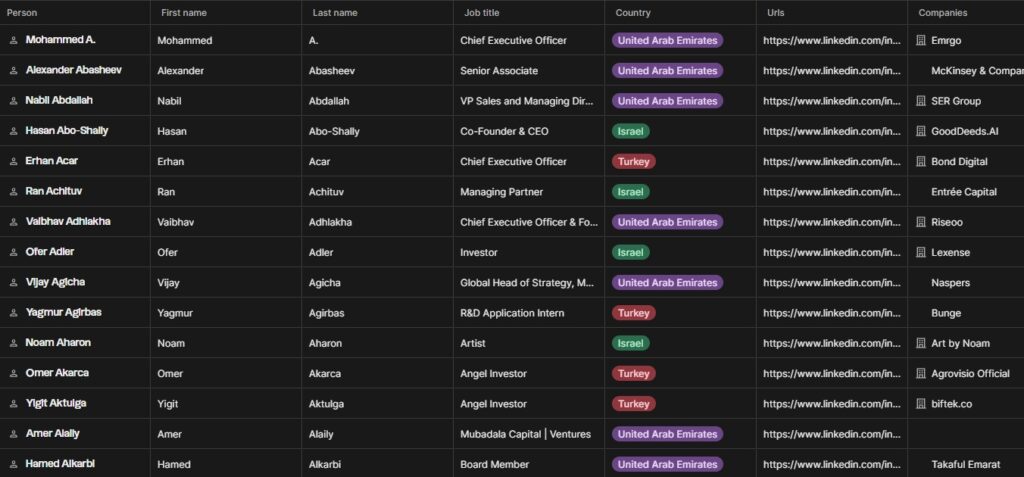

Folk (Middle East)

Folk’s Middle East directory focuses on angel financier networks and early-stage funds active across Middle Eastern markets. The platform provides essential starting point information for founders seeking to access regional capital sources and understand local investment practices. Middle Eastern venture markets exhibit unique characteristics influenced by regional economic conditions, regulatory frameworks, and cultural considerations. This specialized list provides the foundation for understanding regional financier preferences and market dynamics.

Thematic VC Databases: Finding Your Niche Investor

Sector-specific financier lists enable founders to identify venture capital firms with demonstrated expertise and investment thesis alignment in particular industries or impact areas. These specialized resources often provide deeper insights into financier requirements and portfolio fit criteria.

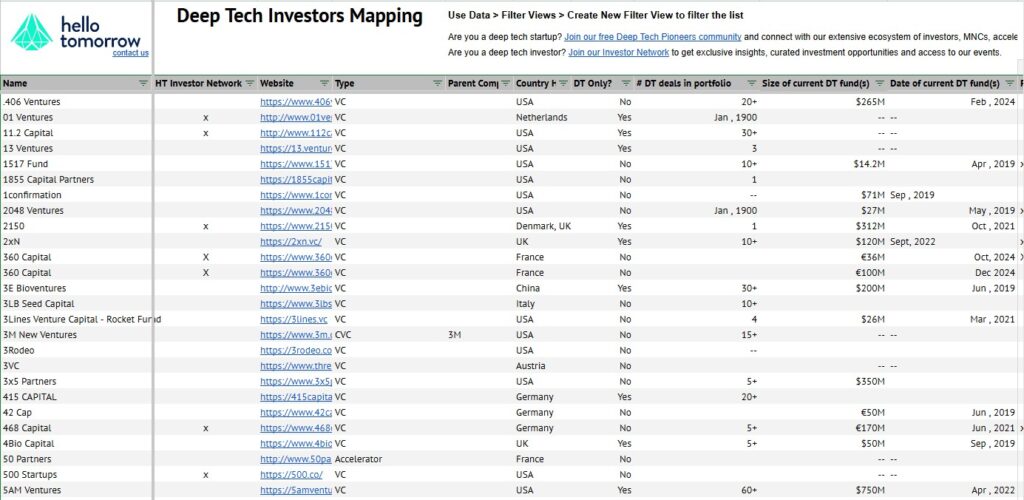

HelloTomorrow (DeepTech)

HelloTomorrow maintains an extensive list of venture capital firms with active DeepTech investment strategies, covering artificial intelligence, biotechnology, quantum computing, and advanced materials sectors. The platform leverages the organization’s position as a leading DeepTech community to maintain current information on specialized investors. The list proves essential for DeepTech founders who require investors with technical expertise and longer investment horizons. Market research data confirms that specialized DeepTech funds demonstrate higher success rates with complex technology ventures compared to generalist investors.

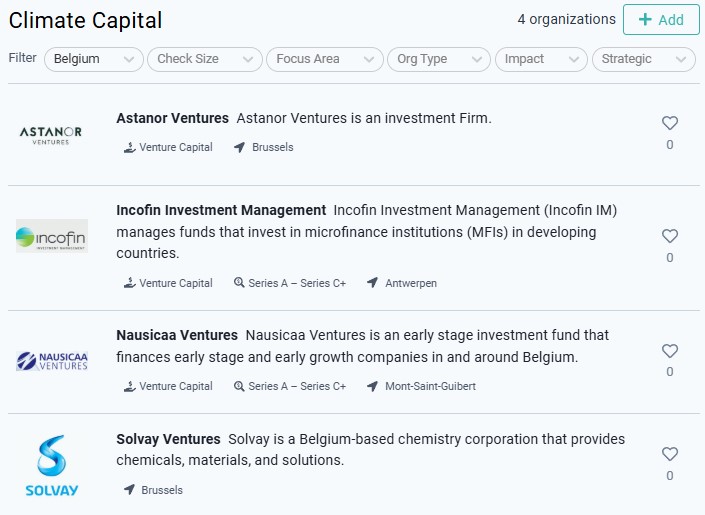

Climatescape (Environmental)

Climatescape operates as a comprehensive directory of funds with environmental and climate-focused investment strategies. The platform covers impact investors, traditional VCs with climate mandates, and specialized environmental funds across different geographic markets. Climate investing has emerged as a significant venture capital segment, with dedicated funds requiring specialized knowledge of environmental regulations, carbon markets, and sustainability metrics. This list enables climate-focused founders to identify investors with appropriate expertise and mandate alignment.

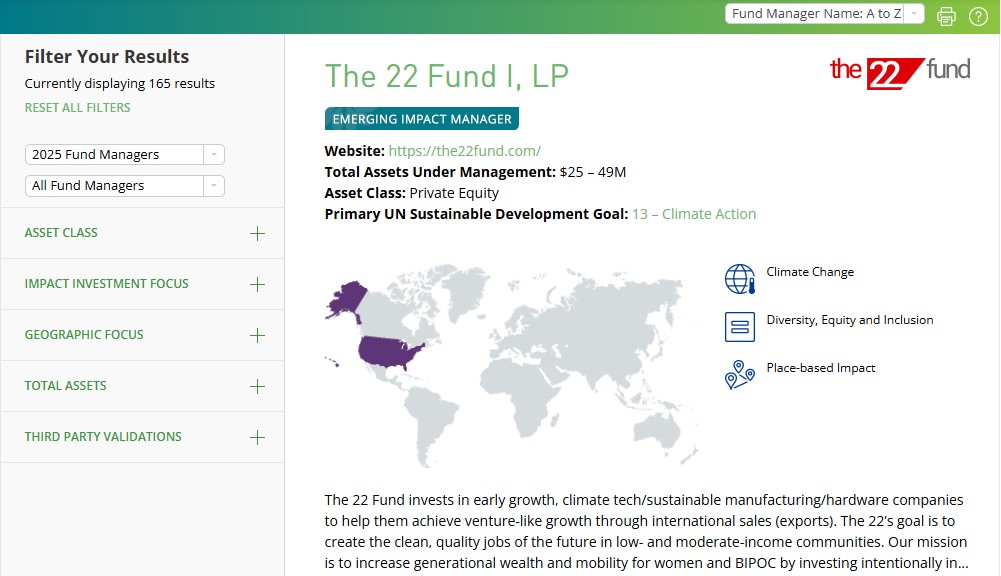

ImpactAssets (Impact Investing)

ImpactAssets maintains a sophisticated list of impact-focused investment funds with filtering capabilities across specific impact goals including:

- Education.

- Healthcare.

- Financial inclusion.

- Global development.

The platform provides detailed fund profiles with impact measurement frameworks and portfolio examples. Impact investing requires alignment between financial returns and social objectives, making specialized financier identification essential for success. The list enables founders to identify funds with appropriate impact thesis alignment and measurement capabilities.

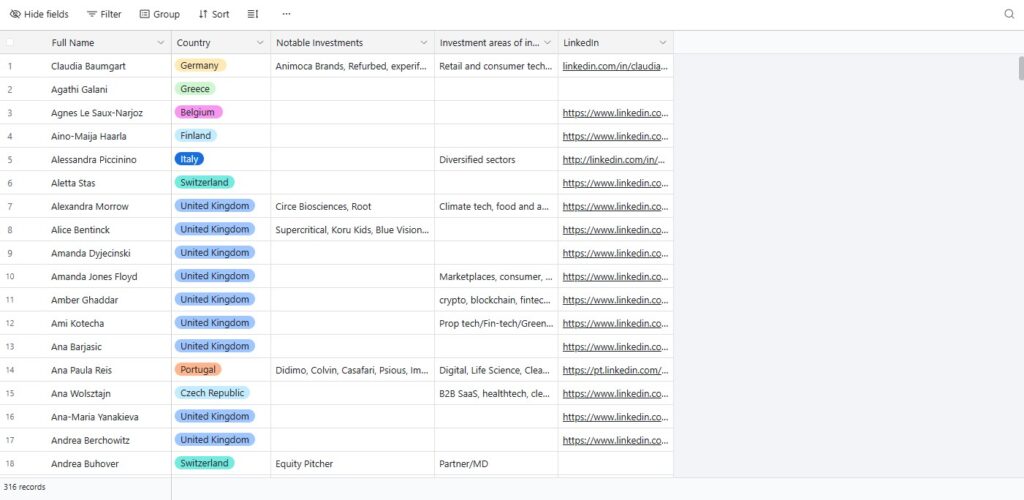

Sifted (Female Angel Investors)

Sifted’s specialized directory addresses the growing recognition of female angel investors as an important capital source in European markets. The platform maintains current information on active female angels across different sectors and geographic regions. Market research data confirms that female angel investors often provide unique perspectives, network access, and mentorship capabilities that complement traditional funding sources. This specialized list enables founders to access this important financier segment effectively.

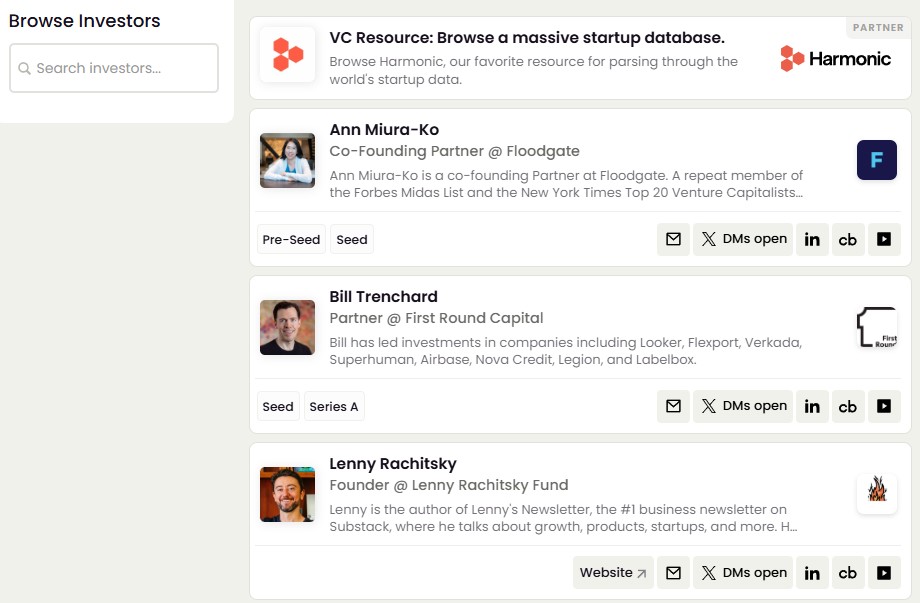

Paid VC Databases: When to Invest in Access

Paid list platforms typically offer enhanced features including advanced filtering, contact verification, deal flow tracking, and integration capabilities that justify subscription costs for active fundraising campaigns. However, in the presence of hidden risks, founders must carefully evaluate data quality and update frequency before committing to paid services. Critical consideration: Many paid lists rely on automated data scraping without sufficient verification processes, resulting in outdated contact information, inactive funds, and inaccurate investment thesis descriptions. Founders should thoroughly research platform methodologies and request trial access before subscribing to paid services.

VC Sheet

VC Sheet provides a curated, filterable list of active global venture capital funds with detailed profiles and integrated fundraising tools. The platform distinguishes itself through manual curation processes and regular verification of fund activity and contact information. The list includes advanced filtering capabilities across multiple parameters including:

- Investment stage.

- Sector focus.

- Geographic preference.

- Recent deal activity.

Integration tools enable direct outreach management and response tracking within the platform environment.

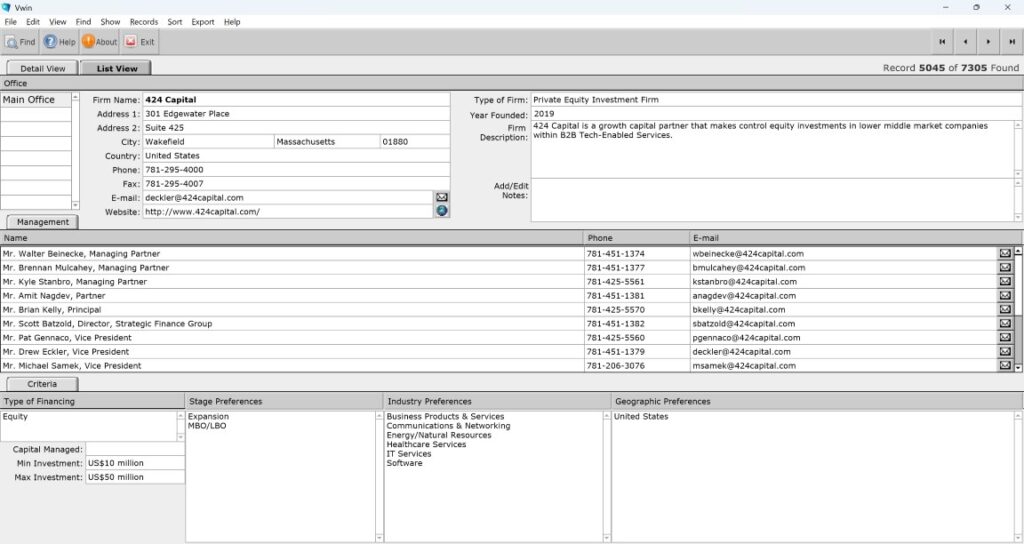

VCPro Database

VCPro Database maintains a regularly updated global list of venture capital and private equity firms with emphasis on data accuracy and comprehensive firm profiles. The platform provides detailed information on:

- Fund characteristics.

- Investment strategies.

- Portfolio companies across multiple markets.

Regular update cycles ensure that fund information remains current as firms evolve their strategies and personnel changes occur. The database’s global scope makes it particularly valuable for founders considering international expansion or seeking cross-border investors.

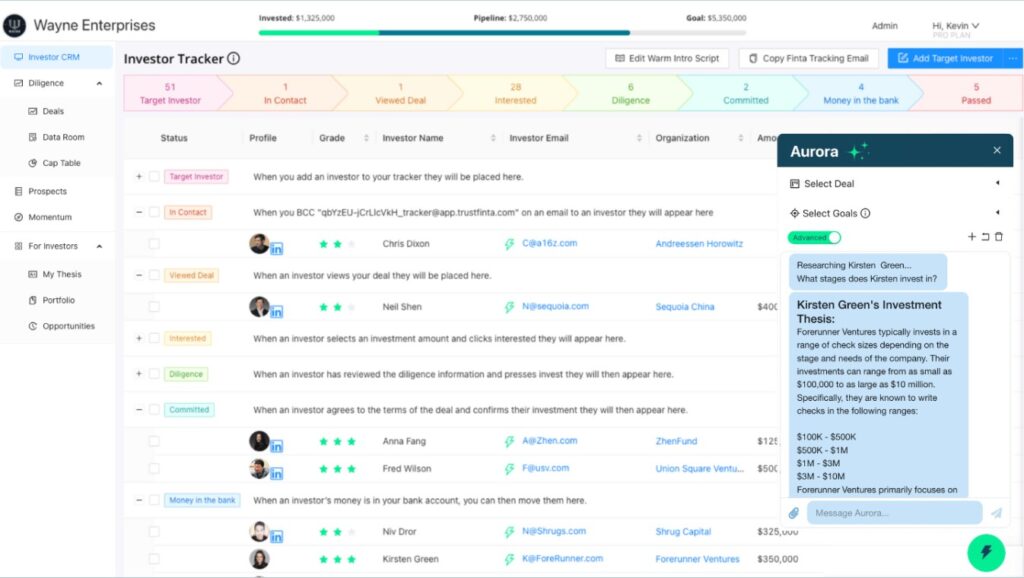

Finta All-in-One Master List

Finta operates as a meta-list that compiles links to numerous financier lists and funding resources. Rather than maintaining its own financier data, the platform provides organized access to multiple external resources with categorization and quality ratings. This approach enables founders to efficiently access multiple list sources without individual subscriptions, though it requires additional verification steps to ensure data currency and accuracy across different source platforms.

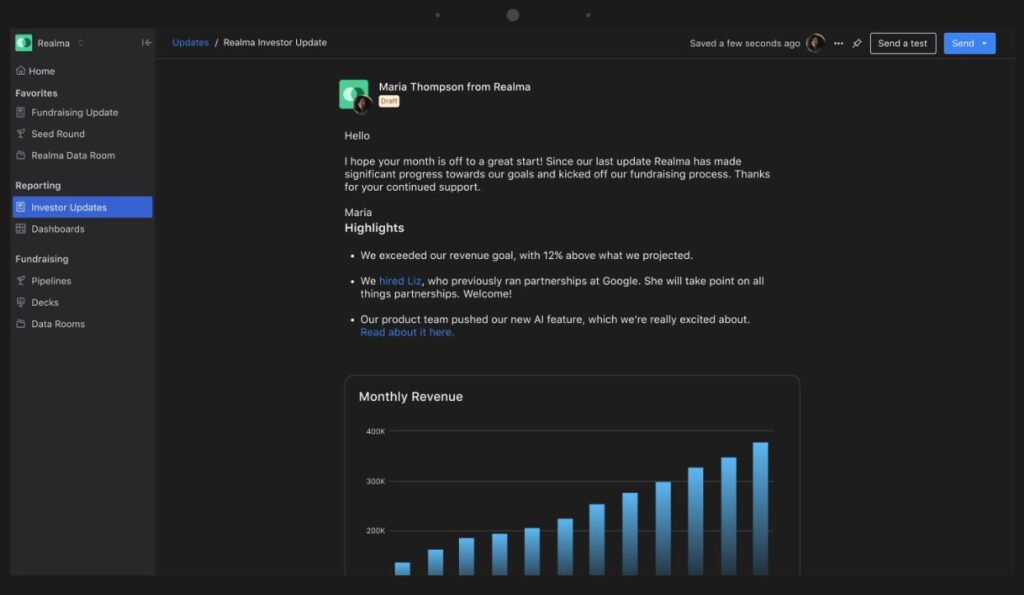

Visible

Visible provides list access integrated with financier relations and reporting tools designed for active fundraising campaigns. The platform combines financier contact information with communication management and progress tracking capabilities. The integrated approach proves valuable for founders managing complex fundraising processes with multiple financier touchpoints and reporting requirements. Database access combines with workflow management tools to streamline fundraising operations.

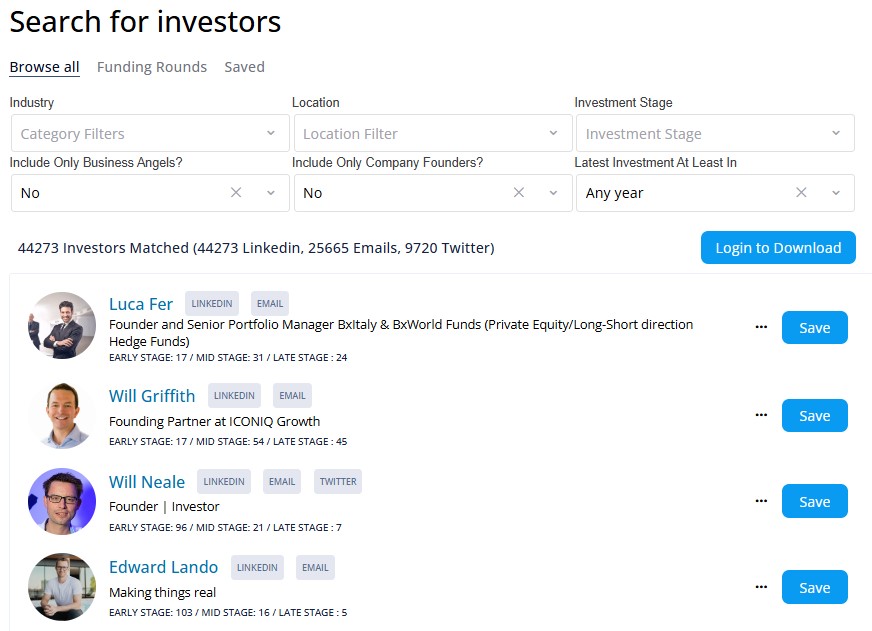

Angels Partners

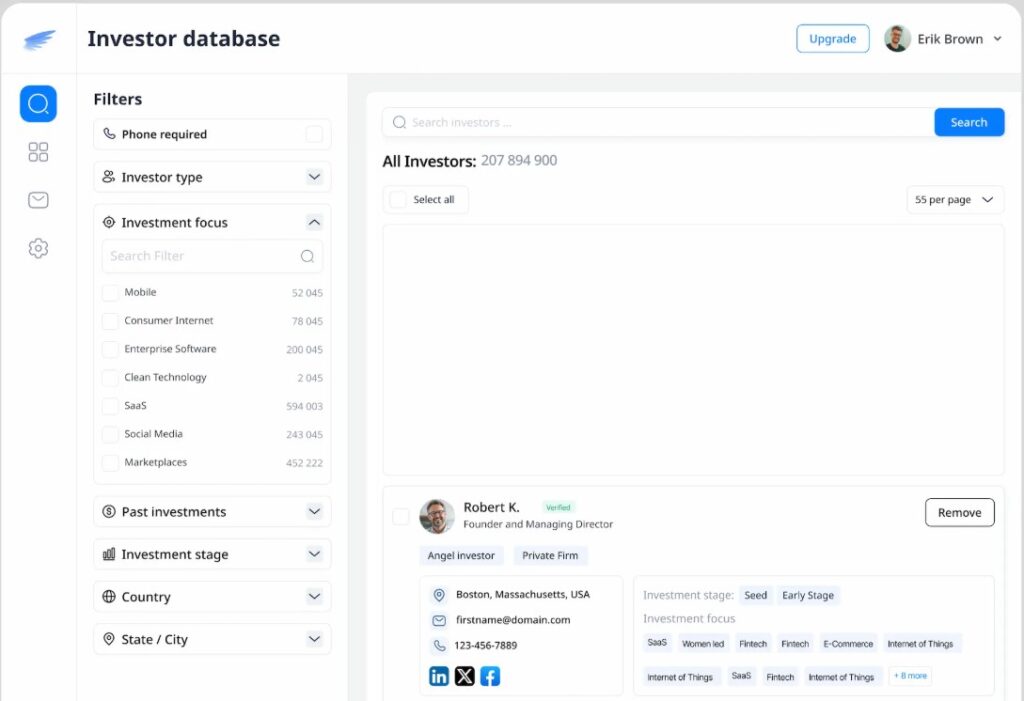

Angels Partners offers access to a list of 100k investors. This platform can be a resource for founders seeking a wide range of potential capital sources.

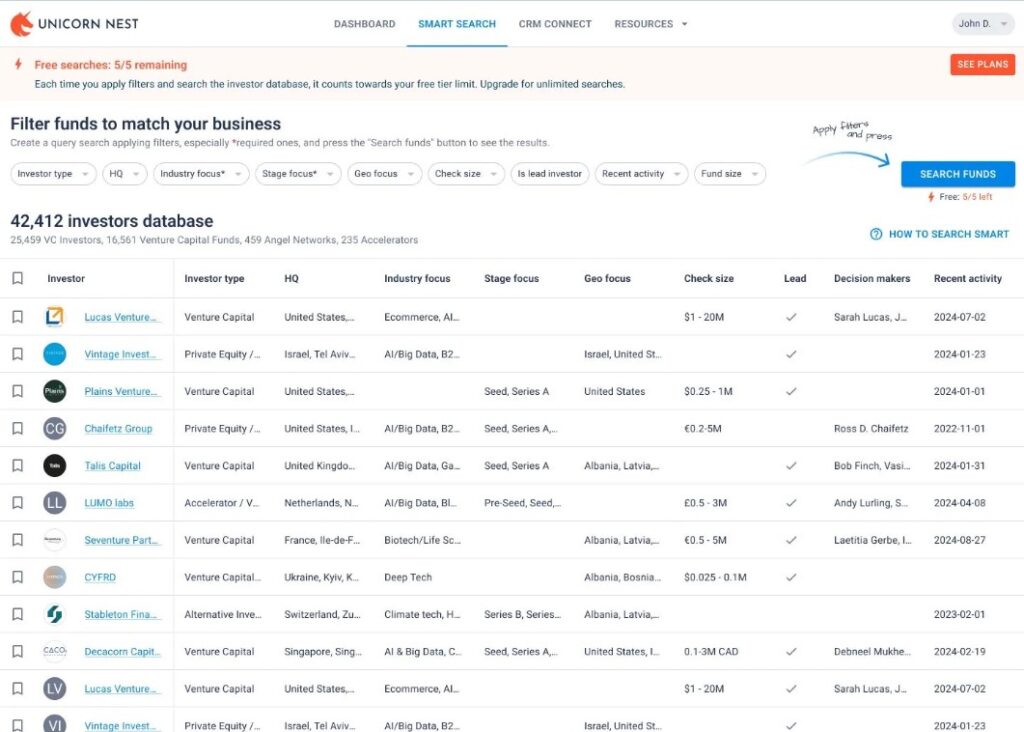

Unicorn Nest

Unicorn Nest provides access to a list of 40k funds. It serves as a tool for founders looking to broaden their search for investment opportunities.

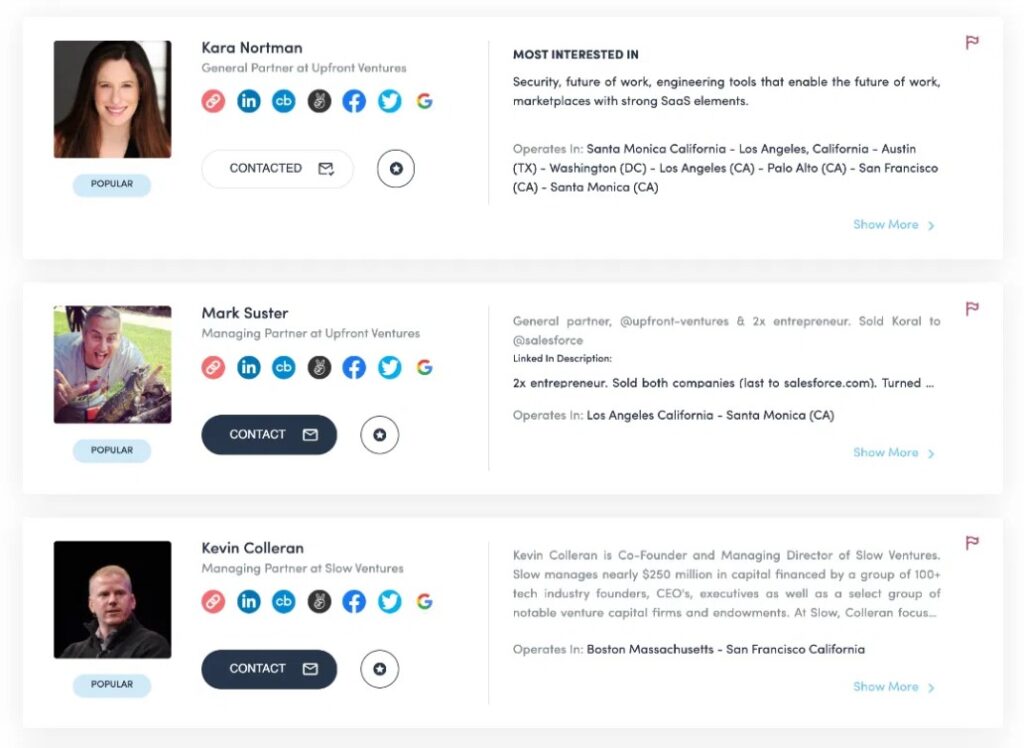

AngelMatch

AngelMatch offers access to a large network of 90k investors, providing founders with a platform to connect with potential funding sources.

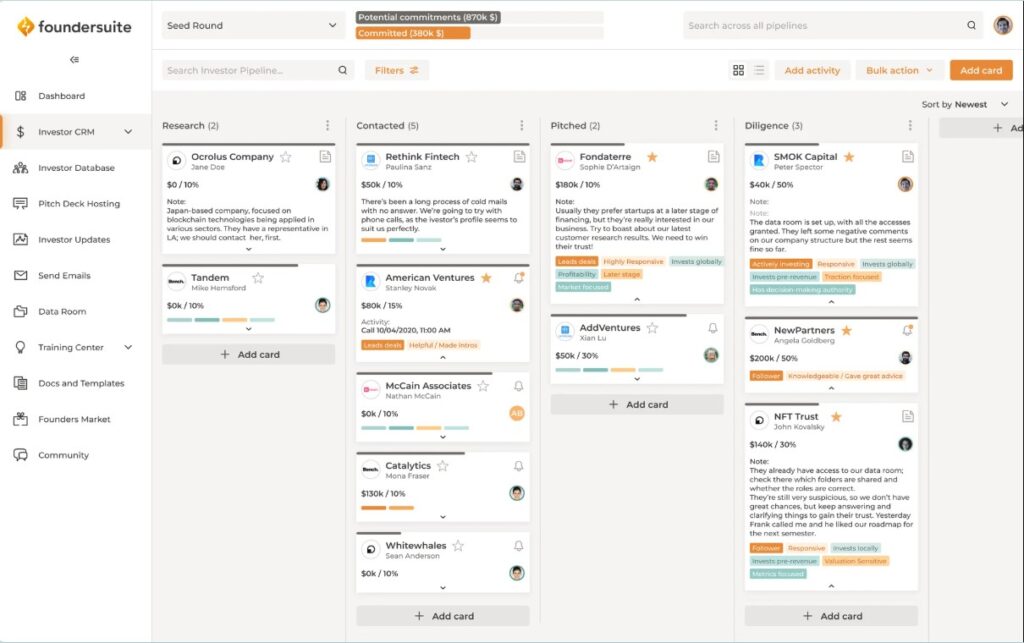

FounderSuite

FounderSuite offers access to a comprehensive list of 200k investors. This platform provides tools to help founders manage their fundraising outreach and tracking.

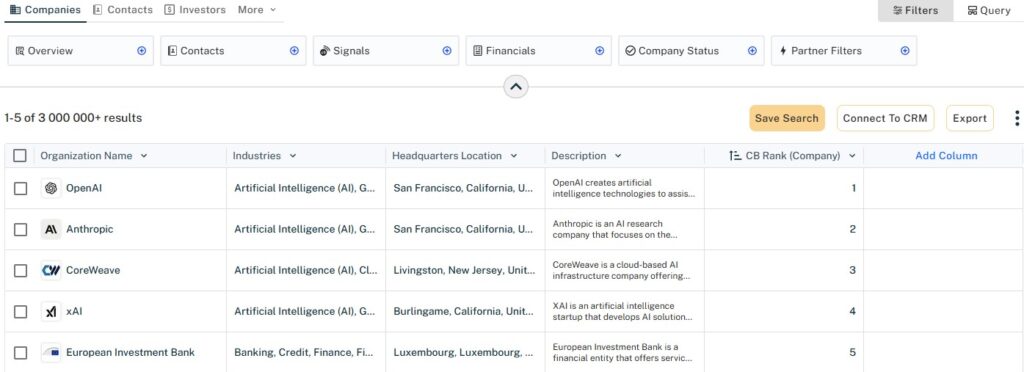

Crunchbase

Crunchbase operates as the most comprehensive list of investors, companies, and market intelligence globally. The platform provides extensive filtering capabilities, deal flow tracking, and competitive analysis tools that extend beyond simple contact information. Market research data confirms Crunchbase’s position as the primary reference for venture capital market intelligence, though subscription costs reflect the platform’s comprehensive scope and advanced analytical capabilities.

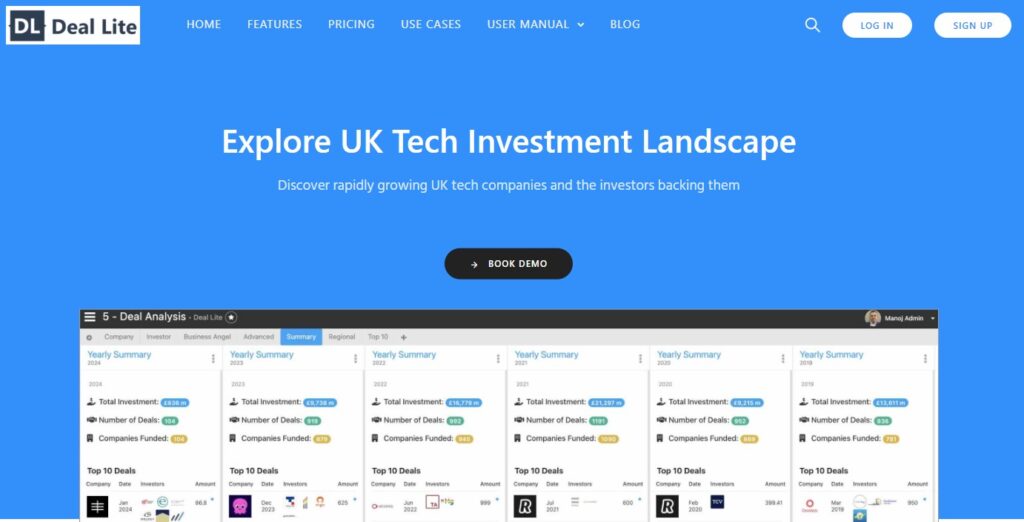

DealLite

DealLite focuses specifically on UK investors, offering a targeted resource for founders seeking capital within the United Kingdom market.

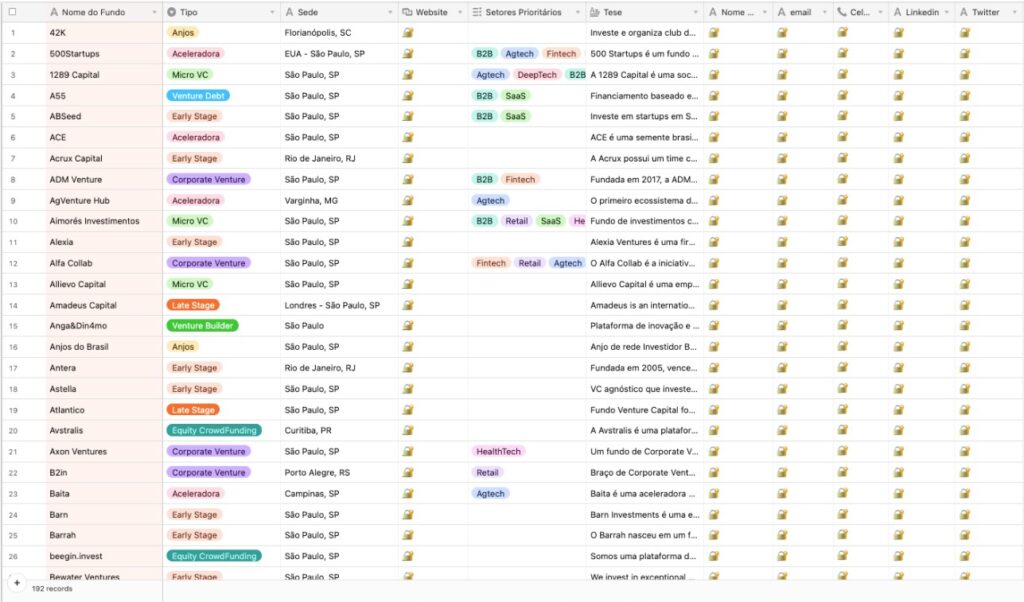

AcheumVC

AcheumVC provides a list of over 200 VC firms in Brazil, serving as a specialized resource for founders targeting the Brazilian venture capital landscape.

Gritt

Gritt offers access to a list of 30,000 angels, providing a focused resource for founders looking to connect with angel investors.

Reputation-Focused VC Databases: Understanding Investor Dynamics

Understanding investor reputation and founder experiences provides essential context for fundraising decisions beyond simple contact information and investment criteria. These specialized resources help founders evaluate potential investors based on actual portfolio company experiences.

Landscape

Landscape positions itself as “Glassdoor for European VCs,” providing authentic founder reviews and ratings of European venture capital firms based on actual investment experiences. The platform covers investor behavior during:

- Due diligence.

- Post-investment support quality.

- Exit processes.

Market research data confirms that investor-founder relationships significantly impact startup success rates, making reputation assessment a critical component of fundraising strategy. Landscape provides the transparency necessary for informed investor selection decisions.

Key Strategies for Using VC Lists Effectively

Define Your Target

Successful list utilization requires clear definition of target investor characteristics before beginning research activities. Founders must establish specific criteria including:

- Investment stage.

- Sector focus.

- Geographic preferences.

- Typical check sizes.

- Strategic value-add requirements.

Within the framework of strategic fundraising, target definition enables efficient list filtering and prevents wasted outreach efforts on misaligned investors. Market research data confirms that targeted approaches generate response rates 3-4 times higher than broad-based outreach campaigns.

Quality Over Quantity

Database access should prioritize financier fit over outreach volume. Depending on market conditions, sending personalized communications to 20 highly relevant investors proves more effective than broad distribution to 200 marginally relevant contacts. Quality-focused approaches require deeper research into:

- Individual investor profiles.

- Recent deal activity.

- Portfolio company alignment.

This additional research investment typically generates higher conversion rates from initial contact to meaningful conversations.

Personalization is Key

Effective list utilization requires customizing outreach based on specific financier characteristics including investment thesis, portfolio companies, and recent market commentary. Generic communications typically achieve low response rates regardless of list quality. Personalization should reference specific portfolio companies, recent investments, or published perspectives that demonstrate alignment with the founder’s market opportunity. This approach signals serious research effort and genuine interest in partnership potential.

Leverage Data for Insights

Database information extends beyond contact details to provide market intelligence about investment trends, fund deployment strategies, and emerging sector preferences. Founders should analyze this data to refine their market positioning and fundraising approach. Investment pattern analysis reveals:

- Optimal timing for outreach.

- Preferred deal structures.

- Competitive dynamics that influence investor decision-making.

This intelligence enables more sophisticated fundraising strategies and improved investor targeting.

Stay Updated

Venture capital markets evolve rapidly with new fund launches, strategy changes, and personnel movements that affect financier accessibility and relevance. Founders should regularly review list sources to maintain current market intelligence. Database maintenance requires ongoing attention as funds complete deployment cycles, launch new vehicles, or modify investment strategies. Regular updates ensure that outreach efforts target active, relevant investors with current contact information.